All About Tax Deducted At Source – TDS Meaning, Filing, Return & Due Dates

It is the Responsibility of the person paying specified payments (Payment karne wala hi katega) to deduct TDS and remit to the government.

For Government_ TDS ensures timely tax collection and helps the government track taxable income throughout the financial year. (TDS deduct hota hai sarkar chalance ke liye)

What is TDS? – TDS Meaning and Full Form

TDS stands for Tax Deducted at Source. Person who making specified payments such as salary, rent, interest, commission, or professional fees. The person deducting tax is known as the deductor, and the person receiving the payment is the deductee.

The deducted amount is deposited with the Income Tax Department (Government) against the deductee’s PAN. Deductee receives the net payment (after TDS) (TDS Katne ke baad paisa jisko dena hai uske dena hai).

If the total TDS is deducted more than the actual tax liability, the excess is refunded after filing the income tax return. (Refund jiska TDS kata hai usko hoga).

TDS Applicable only on following transaction-

- Salary

- Interest on Security

- Interest other than Interest on Security

- Dividend, for an Individual shareholder

- Income from Mutual Fund (This has to be deduct by Mutual Fund company)

- Income from Lottery, crossword, puzzle, etc. (Ticket bechne wala company)

- Income from Horse Race (Ticket bechne wala company)

- Insurance commission (Insurance company TDS deduct karega)

- Commission on Lottery ticket sale (Insurance company TDS Katega)

- Commission on Brokerage (Other commission) (Jo Payment Karga)

- Rent

- Fee for professional or technical services (Payment to Lawyer, CA, CS, etc.) (Jo payment karega wo katega)

- Income by way of enhanced compensation (Jab Land compulsory acquire hota hai aur aapko jitna pehle me baat hua tha usse jyada milna hota hai)

- Remittance under LRS and overseas tour program package (India se bahar paisa bhejne par)

- Partner Remuneration (payment salary to partner)

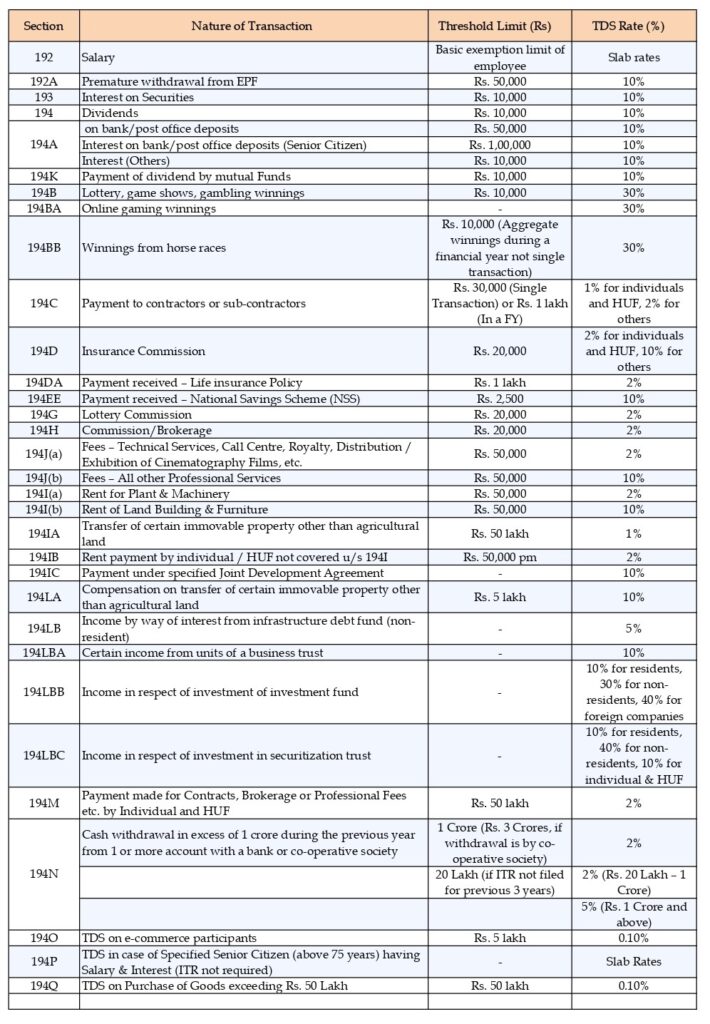

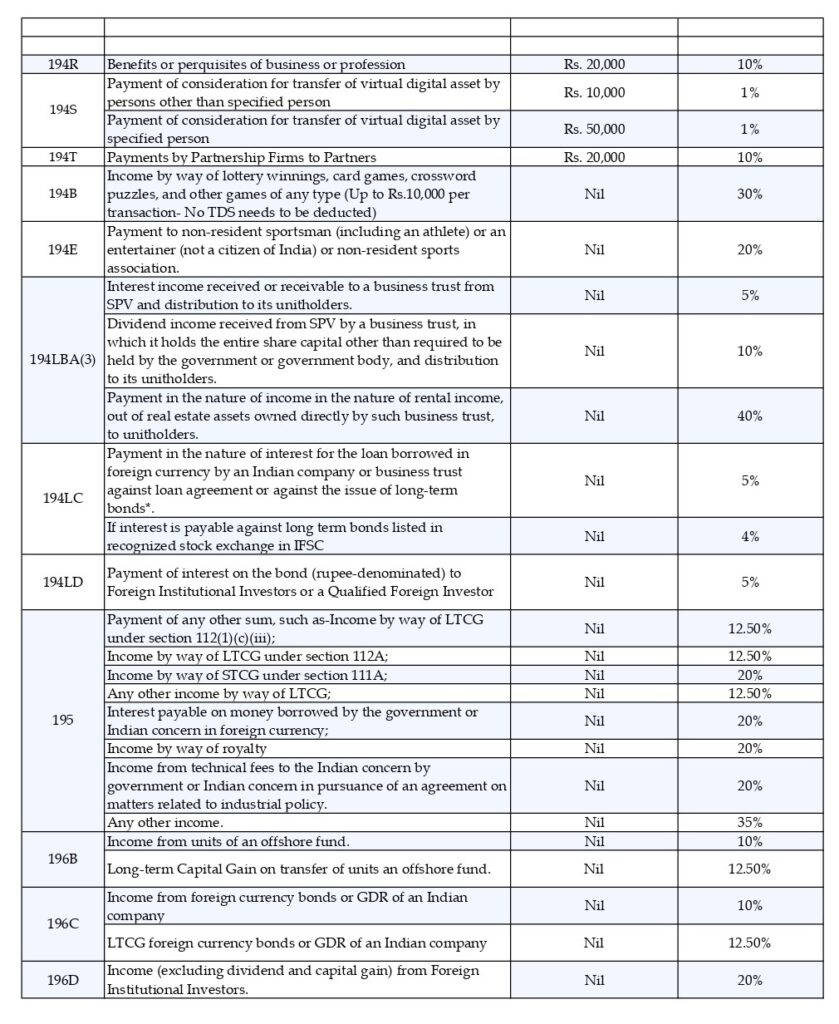

TDS Rate Chart

Please refer to our TDS rate chart to know TDS rates for different kinds of payments.

If the total payment made do not exceed the threshold limit during the financial year, no TDS needs to be deducted.

If the payee declares for 15G or 15H, stating that his taxable income for the financial year would be below the taxable limits, then no TDS needs to be deducted.

TDS Rate Changes FY 2025-26

- The TDS rate for section 194LBC – Income received from investment in securitization trusts for residents has been reduced to 10%.

- With effect from 1st April, 2025, a new section 194T is inserted, wherein TDS has to be deducted on partner’s remuneration at 10%

Example of TDS on Rent

Shine Pvt. Ltd makes a payment for office rent of Rs 80,000 per month to the owner of the property. TDS is required to be deducted at 10% under Section 194I of the Income Tax Act, 1961. Shine Pvt ltd must deduct TDS of Rs 8,000 (i.e., Rs 80,000*10%) and pay the balance of Rs 72,000 to the owner of the property. Thus, the recipient of income i.e. the owner of the property in the above case receives the net amount of Rs 72,000 after deduction of tax at the source. He will add the gross amount i.e. Rs 80,000 to his income and can take credit of the amount already deducted i.e. Rs 8,000 by Shine Pvt. Ltd against his final tax liability.

What is the Due Date for Depositing the TDS to the Government?

TDS must be deposited to the government on or before the 7th of the following month (Jis month me deduct kiya uske agle month ke 7 tarik ko).

Example for when to deposit TDS

TDS deducted for the month of November has to deposit in next month of 7th December. However TDS for month of March can be deposited up to 31st May. (kyuki year end hota hai audit ka time hota hai isliye time March ka 31st May ko hai).

If TDS not deposit in Time then attract interest and penalties under the Income Tax Act.

TDS statements

The TDS statements (Return nahi hai, isme kewel detail dalte hai wo bhi quaterly basis) have to be furnished on a quarterly basis as follows: